Invest now or wait for the stock market crash?

Many experts warn us that we are in for a significant economic downturn. For example, Michael Burry predicted the crisis in 2008, and now he predicts an even bigger crisis. He even followed through on his predictions and recently sold his entire portfolio. In this situation, you may ask: Does it make sense to invest right now? In this article, we will clarify some strategies that can help you find answers to this question.

(The article is inspired by the book “Just keep buying” by Nick Maggiulli, the Chief Operating Officer for Ritholtz Wealth Management LLC. He deals with personal finance using data analysis.)

In the USA, the biggest market crash occurred in 1929, when the market fell by 89.2% (also known as Black Thursday).

For comparison, in 1999, the market fell by 78% during the internet fever. During the 2008 crisis, the market fell by 54.1%. It’s not hard to realize that 1929 represents the most significant crash ever in US history and now imagine you get to 1920 and have to invest in the US stock market for the next 40 years.

Investment approaches you can put into the practice

You have a choice of two investment strategies. (Later, we reveal and explain the third strategy – Lump Sum.)

1. Dollar Cost Averaging (DCA) means averaging dollar costs. You will invest $100 here every month for 40 years.

2. Buy The Dip (BTD) – buying during a dip when you save $100 a month and buying only during a dip, such as in 1929.

Speaking on BTD, we will hypothetically improve this kind of strategy a bit. Not only will you buy on dips, but you will also have a superhuman ability to lead when the market is at its absolute low.

This will ensure that it will always be at the lowest possible price when you buy on a dip. The only other rule in this game is that you cannot buy and sell stocks at will. Once you make a purchase, you keep these assets for a certain period. Which strategy would you choose: Dollar Cost Averaging or Buy The Dip?

Logically, the buy-the-dip cannot go through. However, if we simulate our case, we find that DCA outperforms Buy The Dip more than 70 % of the time. This is true despite knowing when the market bottoms out. Note that Buy The Dip has done quite well since the 1920s due to a major market crash.

After 1930, however, he stopped doing well. As you can read from the graph, in more than 70% of the cases, the curve is below the 0% line, which means the Buy The Dip does not achieve the effectiveness of DCA in 70% of the cases, despite the superhuman timing we had promised earlier.

Buy The Dip only works when I know a substantial drop is coming, and you can time it perfectly. What makes the Buy The Dip strategy even more problematic is that until now, we have assumed that you know exactly when you are at the bottom of the market, but in reality, no human on the planet can. For example, if you miss the bottom by just two months, the success rate of Dollar Cost Averaging versus Buying The Dip increases from 70% to 97%, so even if you guessed the market bottom reasonably well, you would still lose in the long run. If you try to accumulate cash and buy on the next market day, you will probably be worse off than if you purchased every month.

Why? Because while you wait for the next dip, the market will likely continue to rise and leave you behind. Another problem with buying on a dip is that you are unlikely to invest when the market is crashing, and everyone is panicking.

When to apply Dollar Cost Averaging and when to apply to Buy The Dip?

The author’s conclusion is as follows: If even God can’t beat the Dollar Cost Averaging, what chance do you have? As the book title suggests, you’ll be better off in the long run if you keep buying regardless of how the market is doing. You may be asking: If this is true, why did Michael Burry sell his portfolio instead of just buying? Michael Burry is not a long-term investor – his strategy is mainly to look for short-term bets and big wins. If Warren Buffett sold his entire portfolio tomorrow, it would mean something because he is a long-term investor. But Michael Burry is not like that, so it is better to ignore the news that he is selling his portfolio. It means nothing to you as a long-term investor. At this point, you may be thinking: “Ok, the book’s author is quite convincing, and I would like to start investing, but what investment strategy should I choose? Should I invest all the money at once or spread it for one or two years?”

To find the answer, let’s do one more thought experiment. Imagine you were gifted one million dollars and need to invest it. You can only embark on one of two possible investment strategies. You either have to invest all the money right away – we’ll call this option Lump Sum; The option to invest 1 % of cash every year for the next hundred years – we call this option Dollar Cost Averaging. Which variant would you prefer? If you anticipate that the assets you are investing in will increase in value over time, then it should be clear that buying right now will be more beneficial than averaging over a hundred years. Waiting 100 years to invest will not be kind to your purchasing power. By the same logic, we can generalize downwards to periods much shorter than 100 years.

By the same logic, we can generalize downwards to periods much shorter than 100 years. Because if you wouldn’t wait a hundred years for an investment, you shouldn’t wait 100 months or even 100 weeks. For example, let’s say you have $12,000, and again, you need to invest it in one of the two options above. In the case of a Lump Sum (LS), you invest 12,000 dollars, all your funds, in the first month, but in the case of Dollar Cost Averaging in the first month only 1,000 Dollars and in the remaining 11,000, you keep in cash, which you will invest in equal payments one at a time $1,000 over the next 11 months. Visually, it would look like this.

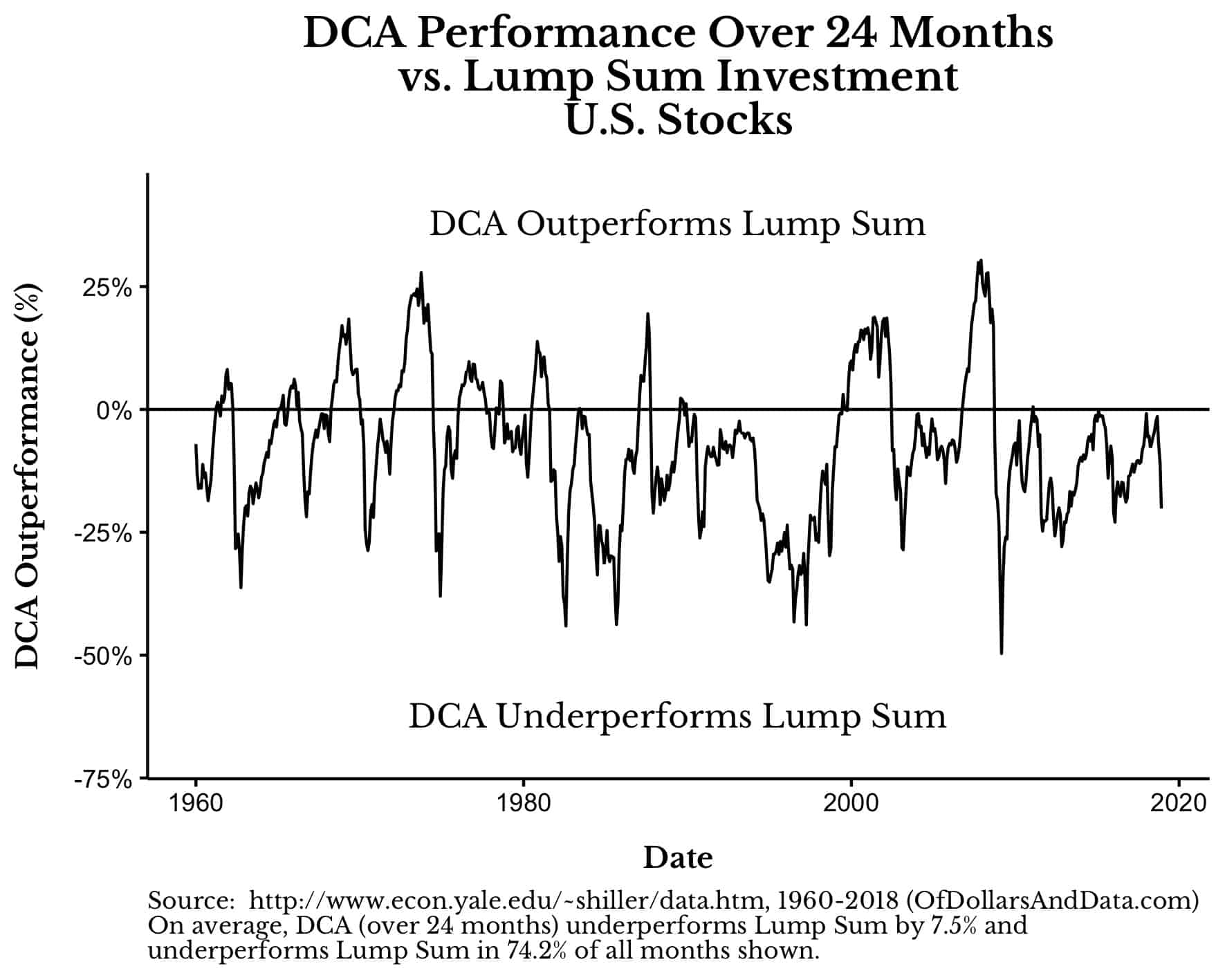

Let’s go back in time and run a simple simulation to see which investment strategies will outperform over the 24 months from 1960 to 2018. Graphically, it would look like this:

When the curve is below the 0% limit, it is a period when Dollar Cost Averaging does not reach the performance of the Lump Sum strategy, and when it is above it, it achieves better results. If you notice, most of the time, the curve is Under the Limit of 0%. At first glance, it is pretty clear that the Lump Sum strategy usually achieves better results, and when it comes to numbers, here are the results: On average, over 24 months, Dollar Cost Averaging is 7.5% weaker than Lump Sum. It achieves lower performance in 74.2% of the five months shown in the graph. By the way, this is not a short time horizon, but 58 years. However, if you still need convincing that the Lump Sum strategy beats the Dollar Cost Averaging strategy, we can extend the period and simulate 1920 to 2018. We will demonstrate this graphically.

And when it comes to numbers, Lump Sum beats Dollar Cost Averaging 68 % of the time, even over such a long-time horizon. The only time Dollar Cost Averaging achieved better results was before the market crash of 1929, 2000, 2008 and so on. This is because DCA is bought in a falling market and thus obtains a lower average price. In most cases, Lump Sum outperforms DCA.

So, what is the conclusion?

For most of history, DCA has underperformed LS.

You can take two more insights from this whole thing:

1. As a long-term investor, you’re better off investing now instead of waiting for a crash.

2. Lump Sum is a better investment strategy across different types of assets and in most cases. It underperforms when investing right before a crash but bounces back over the long term.

When you invest in a diversified portfolio of funds, such as Vanguard FTSE all World that includes 4,115 companies from all over the world, you are investing in the future of humanity. You can apply this to other ETFs as well (for example, S&P 500). And that’s it! You have several options to choose from, but first, you need to know your goals and the period for which you are willing to invest your money. You should have in mind various economic principles as well – you can read more about them in our Getting started guide.