Trading Basics: Stop Hunts, Fakeouts, and Traps

Stop Hunts, Fakeouts, and Traps

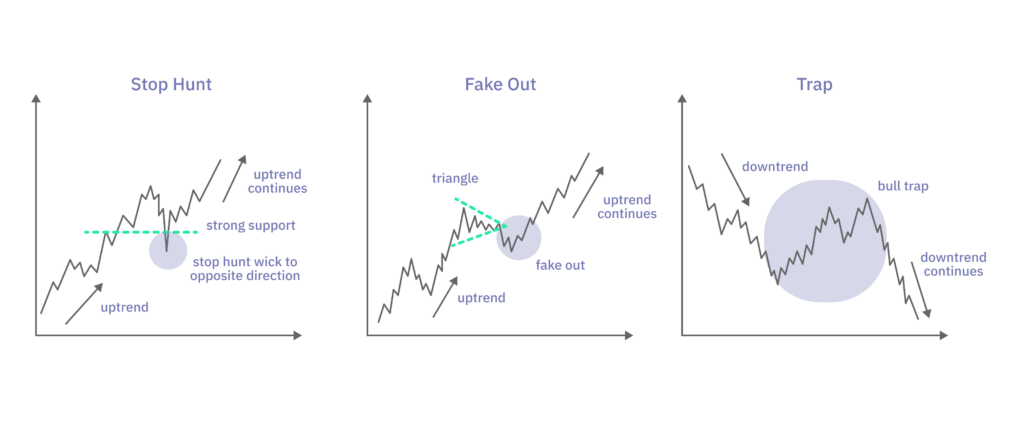

Stop hunts are wicks to the opposite trading direction. Traders push the price in the opposite direction to liquidate open positions (hit stop losses of other traders) in order to add more volume to their trading direction.

Fakeouts usually consist of two or more candlesticks and it is a feature of specific markets. The price breaks to the opposite trading direction than expected, and after a while, the price reverses to the expected trading direction.

A bull trap (when uptrend ends and downtrend starts) or bear trap (when downtrend ends and uptrend starts) is when the market is exhausted and the trend has ended, the market gives a pull back but fails to form a new high (in the ending uptrend) or low (in the ending downtrend). Some traders may think that the trend resumes, and they enter in the opposite direction, but it will not resume because the market is exhausted.