About Price: Brokers and Exchanges

Brokers and Exchanges

Brokers and exchanges are enabling buy or sell assets.

A broker is a financial company enabling the investor to trade on the financial market. For such trading, the broker requests a fee from the investor, especially in the amount of spread or commission (see below). We divide brokers into Dealing Desk (Market Maker) and No Dealing Desk brokers (ECN and STP brokers). Each of these types of brokers has different trading conditions and fees (amount of spreads or commissions) for trading. A broker can be classified as an intermediary of the direct sale or purchase.

Spread is the difference between the purchase (ask) and the sale (bid) price of the trading instrument. Its size depends on market liquidity. If the market is characterized by high liquidity, i.e. the traded item can be quickly converted into cash, the spread on this market is small. If liquidity is low, the spread in this market is high. Liquid markets include, for example, the EUR/USD currency pair, Bitcoin, gold, oil or the S&P 500 stock index.

We differentiate two types of spread: fixed and variable.

With a fixed spread, there is a broker guarantee that guarantees you that the spread will be the same size, even in volatile market situations. In such cases, spreads tend to widen. A fixed spread is larger than a variable spread. This is because a certain part of it is the profit of the broker.

The second type of spread is the variable spread, also called the market spread. It is determined by demand and supply + some amount for the broker for providing the service.

For example, imagine that there are only two traders on the market. The first one is willing to buy an asset for 100$, the second one is willing to sell it for 102$. In this case, the spread is 2$ + some amount for the broker.

What is the difference between liquidity and volume?

Liquidity refers to the efficiency with which an asset can be converted into ready cash without affecting its market price (convertibility into cash). The most liquid asset of all is cash itself.

Volume is a traded quantity during a given period of time.

High liquidity means that we can convert assets into cash, but high volume does not necessarily mean that we can convert assets into cash, because the volume can be either “buy” or “sell” (or both in which case this means high liquidity or convertibility into cash).

For example, if many people sell and there are not enough buyers (which essentially means the supply is low), then the volume is high but we either accept a low price or we might not even be able to convert the asset into cash because there is no buyer who would buy the asset from us.

Commision is a reward (amount of money) paid to a broker or exchange for a sale that it makes. It is usually defined in %.

Dealing Desk brokers (DD) act as liquidity providers on the market and fulfill your orders. When trading through these brokers, orders and trade orders are not executed directly on world exchanges but in the order execution system of the given broker.

Market maker belongs to the group of Dealing desk brokers. Its main task is to quote the price, ensure sufficient liquidity in the market, and fulfill trade orders. The market maker is always willing to buy or sell the underlying asset from you. Every entered trade order (buy/sell) is executed in the Market Maker trading system, and trades do not go directly to the stock exchange. This type of broker does not charge any fee for opening or closing a trading position. Instead, it offers a fixed (firm, precisely determined) spread from which the broker collects a profit. Examples of Dealing Desk brokerages are IG Markets, Interactive Brokers, or EasyMarkets.

No Dealing desk brokers (NDD) fulfill orders and trade orders directly on world exchanges. No Dealing desk brokers forward orders straight to the stock exchange. As it was mentioned above, No Dealing desk brokers are divided into two subcategories: ECN and STP brokers.

An ECN (Electronic Communications Network) is an electronic communication network that enables transactions between buyers and sellers. It is a space where the supply and demand of various banking and non-banking institutions and private traders meet. The presence of these entities ensures high liquidity, which allows the order to be filled with a low spread. The ECN broker offers a variable (market) spread that varies depending on price developments in the market. The ECN broker charges a transaction fee for order execution, which is his profit. Examples of the ECN brokers are RoboMarkets, Exness, LiteForex or ICMarkets.

An STP (Straight Through Processing) broker uses an automated system that sends the client's trade order directly to the world's stock exchanges (NYSE, NASDAQ, CBOT, FOREX) to liquidity providers such as banks and hedge funds.

Straight Through Processing broker is the combination of the Market Maker and the Electronic Communications Network brokers.

STP brokers offer a low spread due to multiple liquidity providers. This type of broker can offer a fixed or variable spread. In the case of a fixed spread, a certain part of the spread becomes his profit, and in the case of a variable spread, the STP broker determines the transaction fee. Examples of the STP brokers are IFC Markets and Swissquote.

In the chart below is an example of spreads for selected popular assets. The spread is based on IFC Markets. Note, the IFC Markets broker fee is around 0.1% - 0.25% depending on the stock exchange (NYSE, NASDAQ etc.).

| Asset | Bid price (“buy”) | Ask price (“sell”) | Spread (Ask – Buy) | Spread (%) |

| Apple (Stock) | 162.36 | 162.61 | 0.25 | 0.15 |

| Facebook (Stock) | 159.03 | 159.26 | 0.23 | 0.14 |

| Google (Stock) | 116.57 | 116.77 | 0.20 | 0.17 |

| Tesla (Stock) | 889.77 | 892.77 | 3.00 | 0.34 |

| BTC/USD (Crypto) | 23,777 | 23,827 | 50.00 | 0.21 |

| ETH/USD (Crypto) | 1,714.60 | 1,724.60 | 10.00 | 0.58 |

| XAU/USD (Gold – Commodity) | 1,771.25 | 1,771.70 | 0.45 | 0.03 |

| XAG/USD (Silver – Commodity) | 20.248 | 20.293 | 0.04 | 0.20 |

| XPD/USD (Palladium – Commodity) | 2,123.50 | 2,128.50 | 5.00 | 0.23 |

| XPT/USD (Platinum – Commodity) | 895.34 | 901.34 | 6.00 | 0.67 |

| EUR/USD (Currency Pairs) | 1.02196 | 1.02212 | 0.00016 | 0.02 |

| GBP/USD (Currency Pairs) | 1.21766 | 1.21793 | 0.00030 | 0.02 |

These spreads were current on July 31, 2022 at 22:57:25 CET

Here is a table with differences between MM, ECN and STP models:

| Full Name | Market Maker (MM) | Electronic Communication Network (ECN) | Straight Through Processing (STP) |

| Dealing model | Dealing Desk | No Dealing Desk | No Dealing Desk |

| Execution | Instant Execution | Market Execution | Instant & Market Execution |

| Spreads | fixed | floating | fixed & floating |

| Commission | no | yes | yes & no |

| Spread cost | high | very low | average |

Source: https://www.100forexbrokers.com/ (adjusted)

Example of trading with spread:

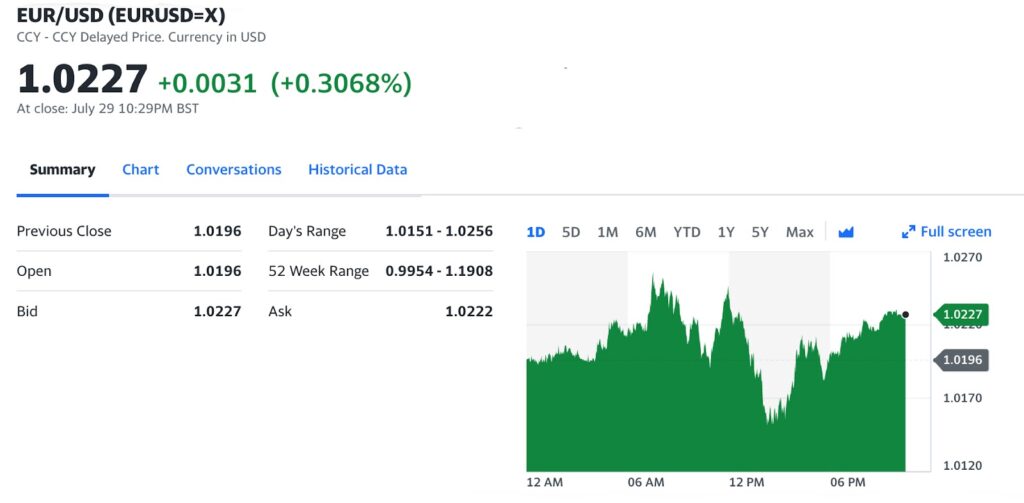

A Forex trader wants to buy the € (euro) in exchange for $ (dollar). In the chart below, the price of € 1.00 equals to $ 1.02 USD. The bid price (“buy”) is 1.0227 and the ask price is 1.0222. This means that the trader can buy € 1.00 for $ 1.0227 (and he would be able to sell € 1.00 for $ 1.0222). So, the spread is 0.0005 (i.e., 1.0227 – 1.0222).

An exchange is a special type of organized market where sellers, buyers and intermediaries (so-called brokers) carry out trades in certain fungible objects (securities, goods, foreign exchange, currencies, insurance policies, services, etc.). The most famous exchanges in the world are, for example, the NYSE (New York Stock Exchange), NASDAQ (National Association of Securities Dealers Automatics Quotation System) and the London Stock Exchange.

In cryptocurrencies we have two types of exchanges. The first one are centralized exchanges, such as Binance, Coinbase, FTX, Kraken, or KuCoin. The second one are decentralized crypto currency exchanges, for example dYdX, Uniswap, Pancakeswap.

Order Types

There are several types of orders that traders can use to initiate the trade (buy) or close the trade (sell). The most common is a market order, a limit order (and its subcategories), stop-loss order, stop-limit order, and take profit order.

A market order enables you to buy or sell an asset immediately at the current price.

A limit order is the opening of a trade position at a different price than the current market price. We recognize 4 types of limit orders – Buy Limit, Buy Stop, Sell Limit, and Sell Stop.

Note, the taker fee of a market order is higher than the maker fee of a limit order.

Buy Limit represents an order that is below the current market price. The trader enters a buy limit when he thinks that the current price will decrease, but will then continue to rise again.

Buy Stop is an order to buy at a higher price than the current price. This type of order is used when the trader thinks that if the price rises above the current market price, it will continue to rise.

Sell Limit is an order above the current market price. A trader enters a sell limit when he thinks that the current price will rise, but then it will fall again.

Sell Stop represents an order to sell, which is at a lower price than the current price. This type of order is used when the trader thinks that if the price drops below the current market price, it will continue to drop.

Stop-Loss Order is a protective order that limits possible losses from an open position. This order automatically closes the trade when a certain price level or amount of loss is reached. Stop-Loss Order is placed either to limit losses or to secure profit.

Take Profit (TP), also known as profit target, is an order ending a trading position in profit without the participation of the trader. The order will automatically close the trade when the price reaches a certain price level.