Commodities you should consider investing in and reasons why (or why not)

When it comes to investing or trading, you have many assets to choose from, including commodities. These assets do not typically generate income, but their price is influenced by supply and demand due to their limited quantity. Rarity and scarcity can also increase the price of commodities, making them a good choice for storing value. In this article, we will explore five different types of commodities that you can put your money into. Apart from that, we will provide pros and cons for each of them.

On our list are these 5 types of commonly traded commodities on the market:

- Precious metals

- Oil

- Agricultural products

- Natural gas

- Industrial metals

When we are clear with this breakdown, let’s cover it.

1. Precious metals

In this case, we can speak about gold, silver, platinum, palladium, or rhodium. They are often seen as safe haven investments and are bought by investors as a hedge against inflation and market volatility.

Some specific reasons why investors may consider investing in precious metals include:

1. Diversification: Precious metals can provide diversification in an investment portfolio, as their price tends to be uncorrelated with other asset classes.

2. Inflation hedge: Precious metals are often seen as a hedge against inflation, as their value may increase as the purchasing power of paper currencies decreases.

3. Safe haven asset: During times of economic uncertainty or market volatility, investors may turn to precious metals as safe haven assets to protect against losses in other asset classes.

On the other hand, investing in precious metals also carries some risks. For example:

1. Price fluctuations: The price of precious metals can be highly volatile and may fluctuate significantly over time.

2. Storage and insurance costs: Precious metals must be stored and insured, which can incur additional costs for investors.

3. Limited returns: Precious metals do not generate income in the same way as stocks or bonds, and may not offer the same potential for returns. We mentioned several differences between gold and other investment opportunities in one of our articles (check the Advantages and Disadvantages of gold).

Whenever times are hard, no amount of inflation can negate the fact that gold is a precious metal that is in limited quantity on earth. That is why even during war conflicts, many people resort to this commodity.

2. Oil

Crude oil is a key commodity that is in high demand for transportation and manufacturing, making it a popular investment choice. We all know that without oil we couldn’t do such fundamental things as traveling across countries or creating plastic products.

These are the reasons why you should consider investing in crude oil:

1. Strong demand: Crude oil is widely used in various industries and is likely to continue to be in high demand in the long term. Especially because of its use as fuel.

2. Volatility: The price of crude oil can fluctuate significantly, providing investors with opportunities to buy and sell at advantageous prices.

3. Diversification: Adding crude oil to an investment portfolio can diversify holdings and potentially lower the risk.

However, investing in crude oil also carries some risks. For example:

1. Price fluctuations: Crude oil prices can be volatile and subject to significant fluctuations due to supply and demand, economic conditions, and political events.

2. Dependence on global economic conditions: The demand for crude oil is closely tied to global economic conditions, and a slowdown in economic activity can impact the price of oil.

3. Environmental concerns: There are also environmental concerns associated with the extraction and use of crude oil, which may impact its long-term demand and price. It is a non-renewable source of raw material, so its cost may be higher if alternative energy sources are not used.

3. Agricultural products

Commodities such as corn, wheat, and soybeans are important for food production and are subject to supply and demand fluctuations.

Pros that stem from investing in agricultural products are the following:

1. Demand: The demand for agricultural products is generally consistent, as they are essential for feeding a growing global population.

2. Price fluctuations: The price of agricultural products can fluctuate due to factors such as supply and demand, weather events, and disease outbreaks, which can create opportunities for investors to buy and sell at favorable prices.

3. Diversification: Including agricultural products in an investment portfolio can help to diversify holdings and potentially reduce overall risk.

Despite the aforementioned advantages, you should take into account possible cons. For example:

1. Price fluctuations: The price of agricultural products can be highly volatile and subject to significant changes due to factors such as supply and demand, weather events, and disease outbreaks.

2. Dependence on the weather: Agricultural products are also subject to the impacts of weather, which can affect crop yields and impact prices.

3. Limited returns: Agricultural products may not offer the same potential for returns as other asset classes, such as stocks or bonds.

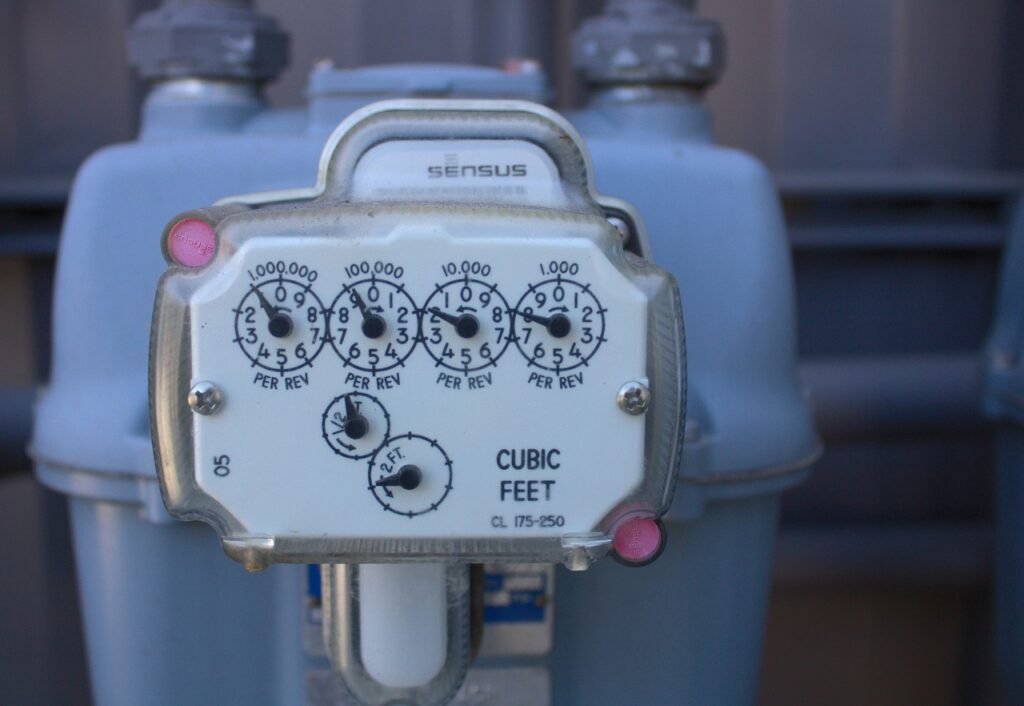

4. Natural gas

Natural gas is a clean-burning fossil fuel that is used for heating and electricity generation. It is also a key component in the production of chemicals and plastics. We do not have to mention how many things are made of plastics so the need for this commodity is understandable. And that reflects the prices.

Investing in natural gasses brings with itself these benefits:

1. Long-term demand: The demand for natural gas is expected to grow in the long term as it becomes a more popular choice for power generation due to its cleaner-burning properties.

2. Price changes: The price of natural gas can change due to supply and demand factors, providing investors with opportunities to buy and sell at advantageous prices.

3. Diversification: Adding natural gas to an investment portfolio can diversify holdings and potentially lower the risk.

To be honest, we must admit a few drawbacks as a contrary side:

1. Price fluctuations: Natural gas prices can fluctuate significantly due to factors such as supply and demand, economic conditions, and political events. Certain countries are dependent on one supplier.

2. Dependence on global economic conditions: The demand for natural gas is closely tied to global economic conditions, and a slowdown in economic activity can impact the price of natural gas.

3. Environmental concerns: There are also environmental concerns associated with the extraction and use of natural gas, which may impact its long-term demand and price.

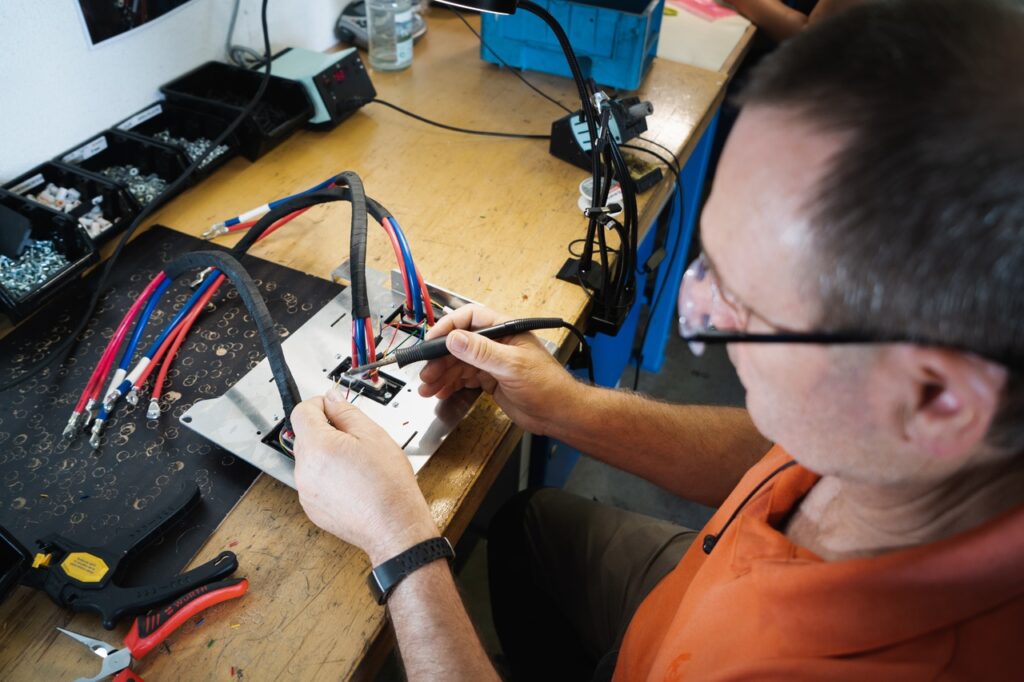

5. Industrial materials

Metals such as copper, aluminum, and steel are used in a variety of industries and are subject to supply and demand forces. We can speak about copper, steel, aluminum, lead, etc. They are commonly used for example in manufacturing, factory work, the electronics industry, and others. Simply said – it is needed.

So let’s have a look at those pluses that links to investing in industrial materials:

1. Demand: Industrial metals have a range of uses and are likely to continue to be in high demand in the long term.

2. Price fluctuations: The price of industrial metals may change due to supply and demand, which can provide investors with opportunities to buy and sell at advantageous prices.

3. Diversification: Adding industrial metals to an investment portfolio can diversify holdings and potentially lower overall risk.

To balance that here are some downsides:

1. Volatility: The price of industrial metals can be volatile and subject to significant fluctuations, which can make them risky investments.

2. Market factors: Industrial metals prices can be affected by various market factors such as global economic conditions, political instability, and natural disasters.

3. Storage and transportation: Industrial metals can be physically heavy and require storage and transportation, which can increase costs and logistical challenges.

4. Environmental concerns: Extracting and processing industrial metals can have environmental impacts, which may be a concern for some investors.

So, what is the takeaway from this article? That you have a wide range of possibilities when you want to invest or trade, but before taking action, think twice about advantages as well as disadvantages of various commodities. Diversify your portfolio and have in mind that non-renewable or limited sources will cost much in the future more than they cost now. (If we stick to the same sources and do not take steps for using substitutes.)